Report: Hot Topics in Epilepsy Drug Development 2023

Hot Topics in Epilepsy Drug Development | 2023

Date of publication: June 2023

Target audience: Pharma/Biotech Industry

Corporate purchase price: 1750 EUR

Report overview

Many of the current efforts on new drug development for epilepsy focus on two areas: developmental and epileptic encephalopathies (DEEs), and drug-resistant epilepsy. The Hot Topics in Epilepsy Drug Development report analyses four major topics of relevance for drug development in epilepsy in 2023 [Published June 2023]

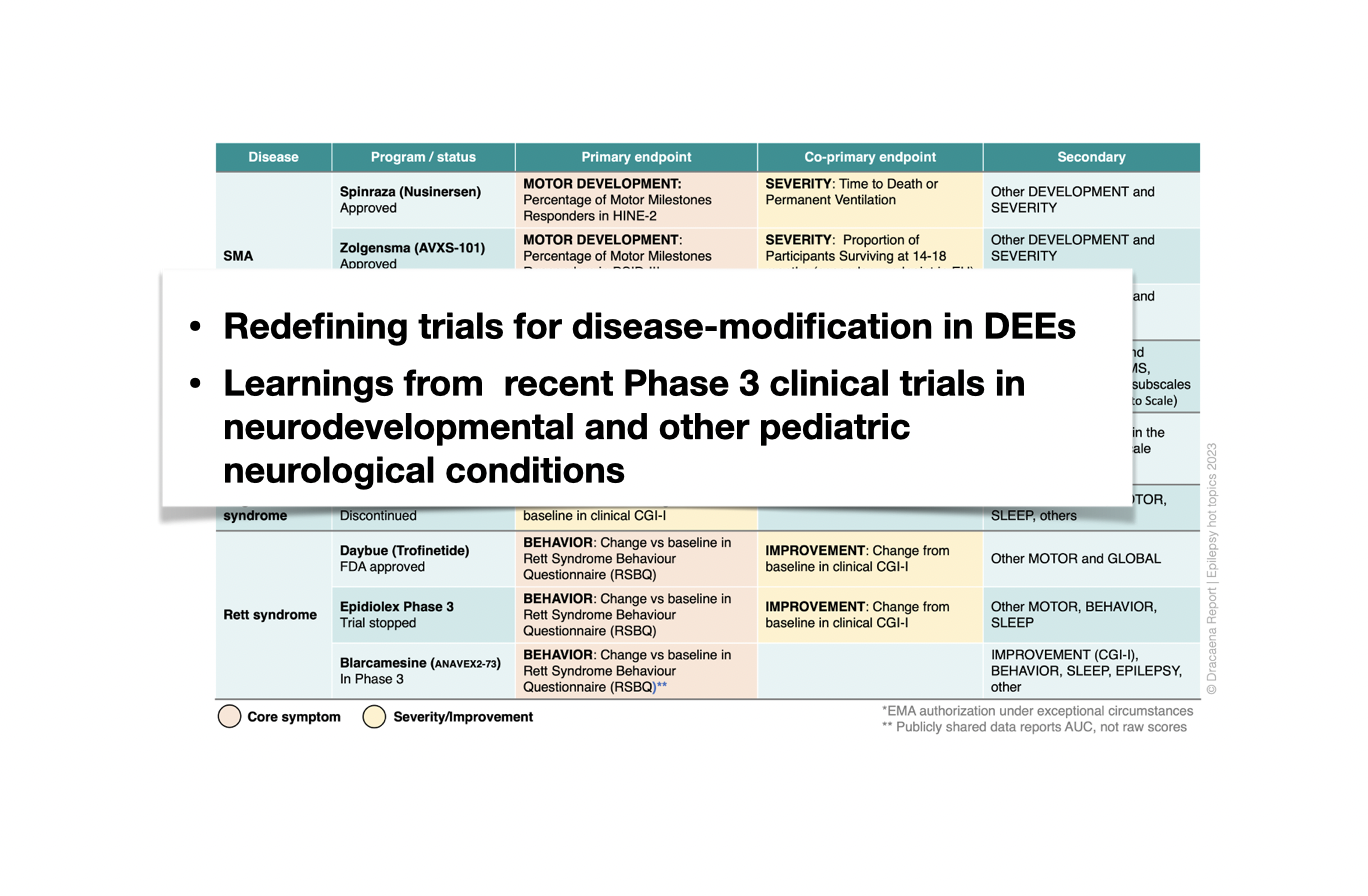

1. The arrival of new therapeutic approaches that target the underlying cause of DEEs requires a change in how we design clinical trials for DEEs. There are no regulatory precedents for approvals of a therapy for treating a DEE (only for treating seizures in a DEE), but EMA guidelines and recent late-stage trials in neurodevelopmental and pediatric neurological diseases converge on a common outcome strategy. We discuss these strategies, implications for clinical trials in DEEs, and possible label and reimbursement implications.

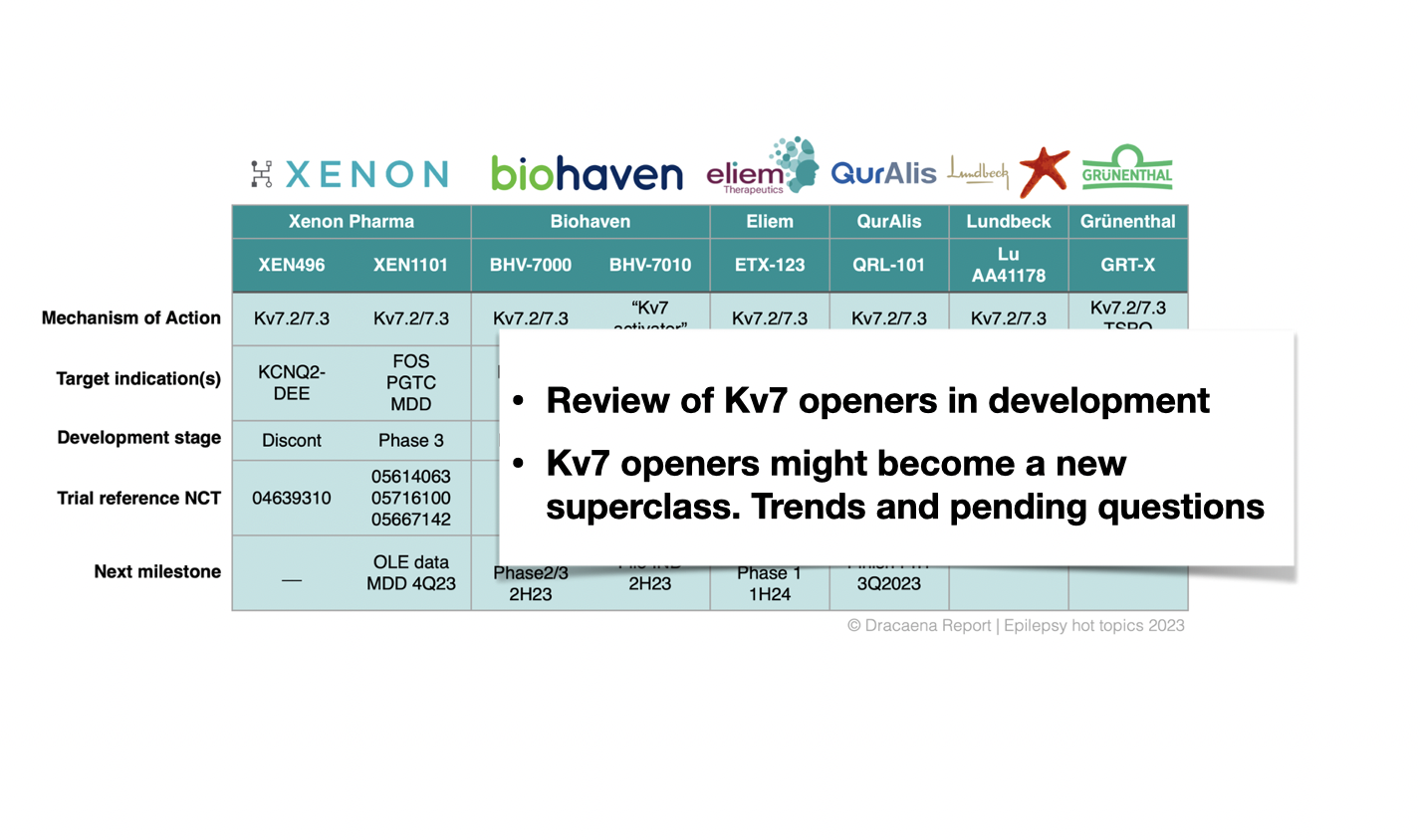

2. One of the hot topics in epilepsy drug development right now is the growing pipeline of Kv7 openers for drug-resistant epilepsy. We describe a growing pipeline of eight Kv7 channel openers, with impressive clinical results from the frontrunner. We predict that potassium channel openers could become the new superclass of drugs to dominate the epilepsy space and to also expand to neuropsychiatric indications. Big questions remaining are whether they can be safer than the ill-fated ezogabine, and how many of these Kv7 modulators can the market take.

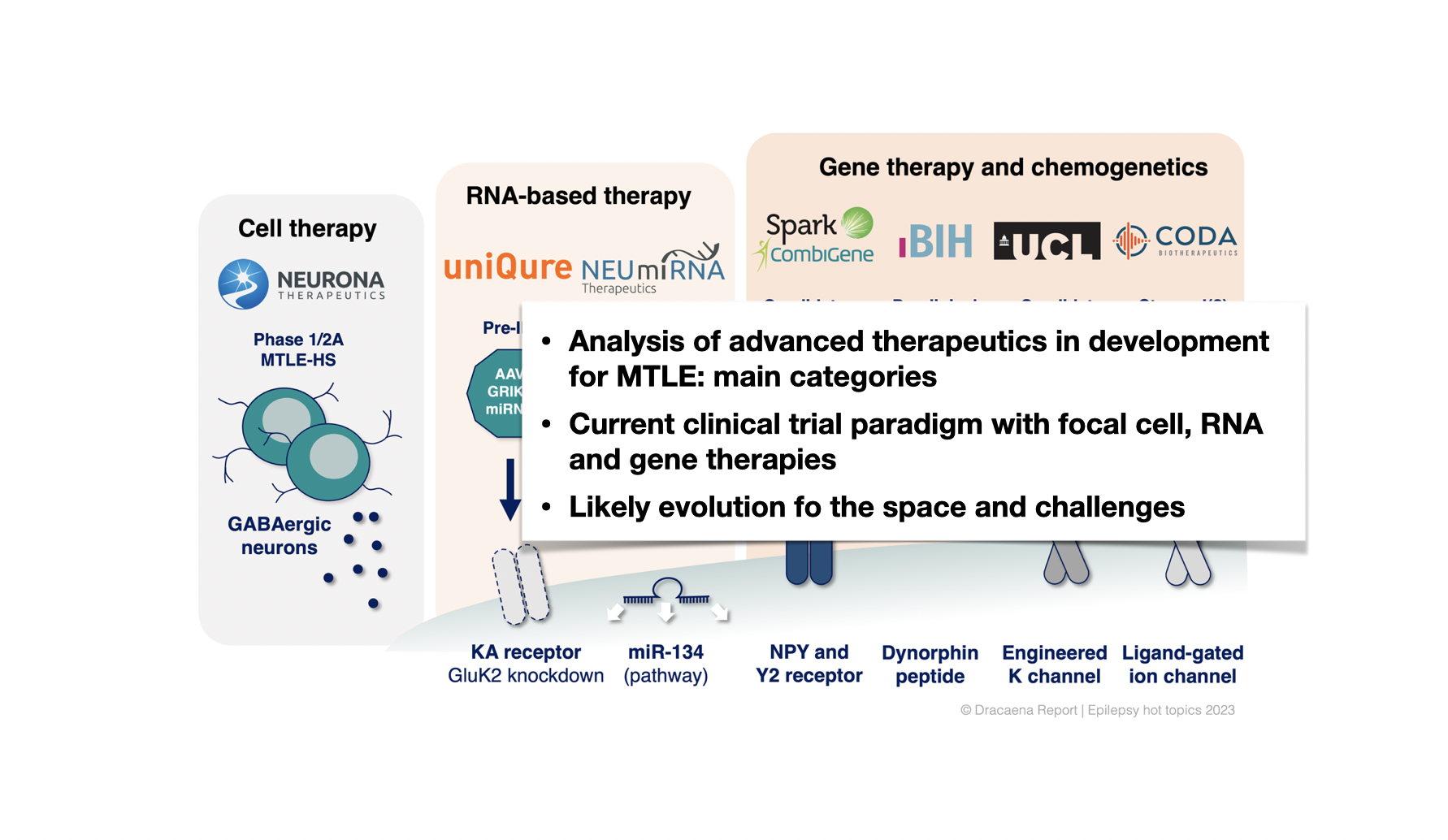

3. In addition to small-molecule drugs, there is a growing group of advanced modalities in development for targeting drug-resistant focal epilepsies. Mesial temporal lobe epilepsy (MTLE) has emerged as the chosen entry indication for clinical trials. We analyze seven of these advanced therapeutics, and classify them into cell therapy, RNA therapy and gene therapy classes. We also describe the current clinical trial paradigm with advanced modalities in focal epilepsy, the possible future indications for these treatments, and how trial enrollment might become a barrier in this space.

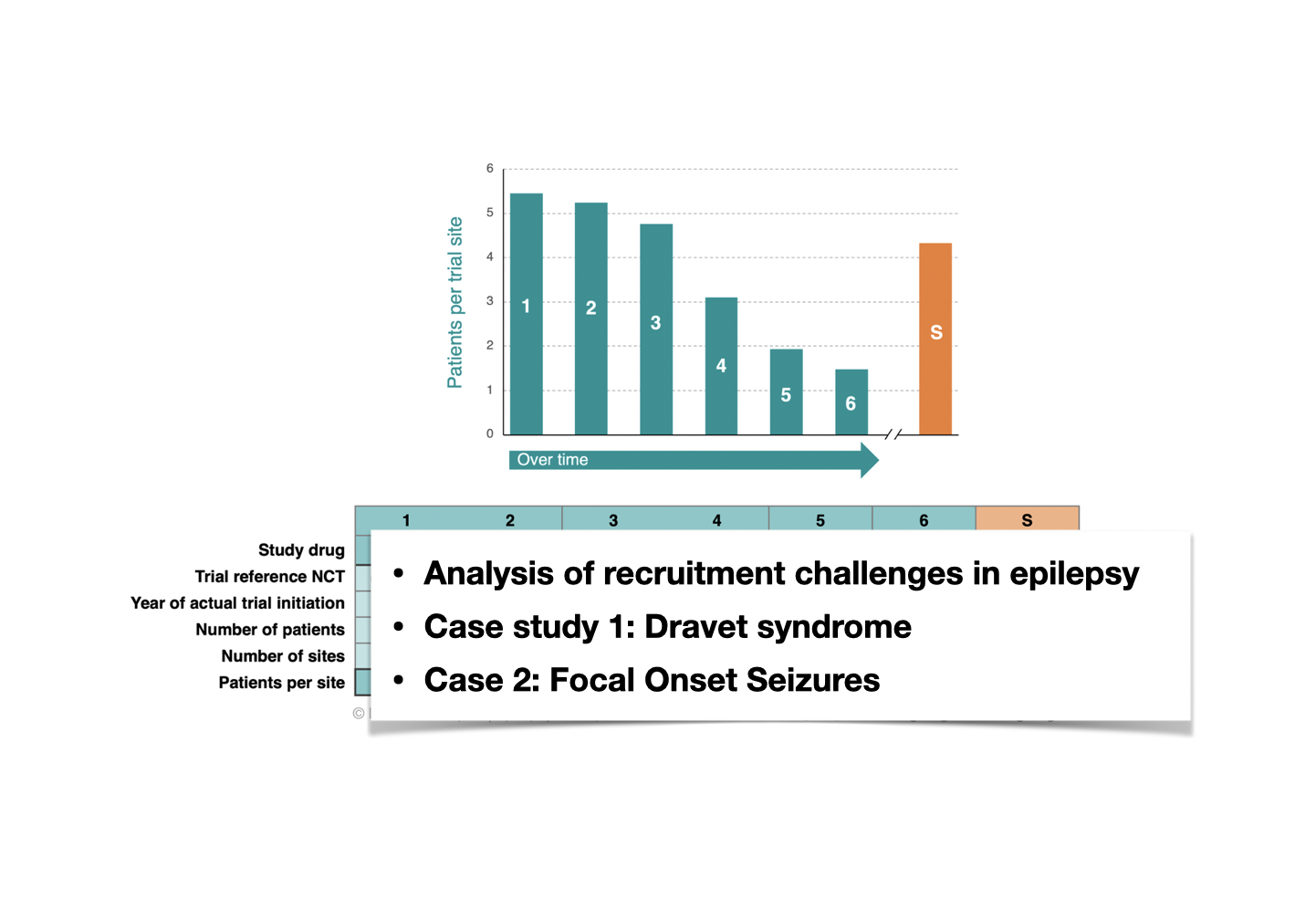

4. The growing challenges in clinical trial recruitment are another hot topic in the broader epilepsy space, impacting rare indications as well as common epilepsy types. We analyze recruitment trends over time in Dravet syndrome as a case study for how clinical trial recruitment might evolve over time in DEEs. There is a nearly 4-fold drop in recruitment rate between the first Phase 3 trials in Dravet syndrome and the more recent ones. The STK-001 program might break this trend. We also review recent data about trial eligibility becoming a challenge for focal onset seizures. If the current recruitment trends continue, it will become important to find strategies to enroll patients with fewer seizures into trials.

Companies and programs included:

Biohaven (BHV-7000 and BHV-7010), Capsida (STXBP1 gene therapy), CODA Biotherapeutics (chemogenetic gene therapy), Eisai (lorcaserin), Eliem Therapeutics (ETX-123), EpiBlock Therapeutics (Dynorphin gene therapy), Grünenthal (GRT-X), GW Pharma (cannabidiol), Lundbeck (Lu AA41178), NEUmiRNA (NMT.001), Neurona Therapeutics (NRTX-1001), QurAlis (QRL-101), Spark Therapeutics and CombiGene (CG01), Stoke Therapeutics (STK-001), Takeda (soticlestat), UCB Pharma, uniQure (AMT-260), University College London (EKC gene therapy), Xenon (XEN1101 and XEN496), Zogenix (fenfluramine).

Mentioned: Encoded Therapeutics, Marinus Pharma, Neurocrine Biosciences, Ovid Therapeutics, Praxis Precision Medicines, Ultragenyx.

Figures and tables:

Primary endpoints used for a selection of recent Phase 3 clinical trials in neurodevelopmental and other pediatric neurological conditions.

The transition from epilepsy trials to syndrome/DEE trials represents a substantial increase in trial design complexity.

Examples of endpoint selection from prior pediatric neurological disease trials depending on the clinical characteristics of each indication, grouped under three categories.

Selection of Kv7 openers in development as of June 2023.

Current clinical trial paradigm with cell, RNA and gene therapies in MTLE.

Main classes of therapeutics in development for MTLE or that have shown preclinical proof-of- concept in MTLE models including cell therapy, RNA-based therapy and gene therapy.

Recruitment trends in Dravet syndrome trials.

Fraction of patients eligible for FOS trials.

Preview some of the content